health insurance pet veterinary decisions that protect your peace

The point isn't paperwork - it's outcomes

You want your vet to focus on treatment, not price tags. Good coverage turns a hard moment into a manageable one. It won't fix everything, but it often shortens the distance between diagnosis and care. Less hesitation. More options. Fewer spiraling costs.

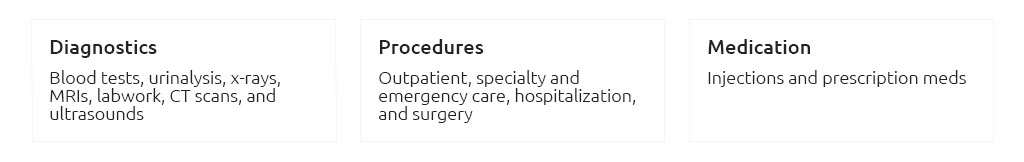

What it usually covers

Policies tend to center on the big, unpredictable stuff. The details matter, yet the theme is consistent: protection from shocks.

- Accidents: broken bones, foreign body surgery, lacerations.

- Illnesses: infections, chronic conditions, cancer care.

- Diagnostics: X-rays, ultrasound, blood panels, sometimes advanced imaging.

- Medications: approved prescriptions; compounding may vary.

- Hospitalization and surgery: including anesthesia and monitoring.

- Rehabilitation: hydrotherapy, physio - often included, sometimes capped.

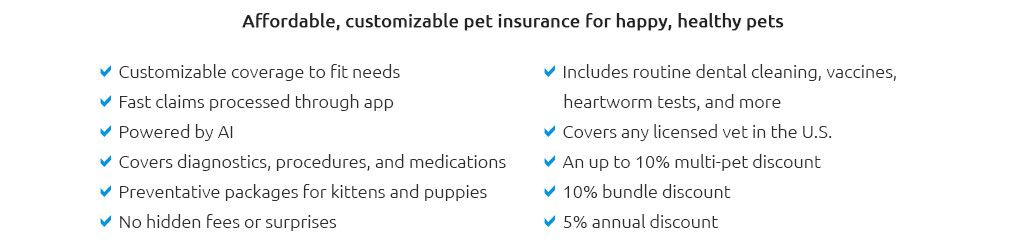

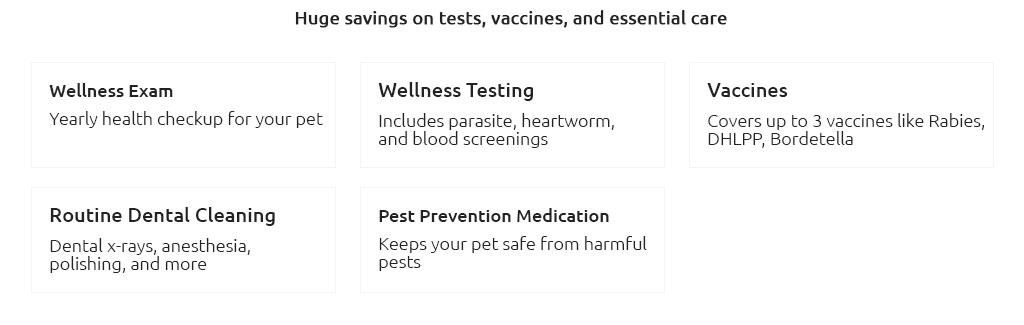

- Optional wellness add-ons: vaccines, dental cleanings, flea prevention; helpful for budgeting, not always valuable dollar-for-dollar.

Why it matters at the vet

Speed and confidence save outcomes. Vets often recommend a diagnostic path; insurance helps you say yes sooner. A real moment: the receptionist prints an estimate, you open the insurer's app, snap the itemized invoice, and receive a claim number before you leave. The X-ray happens. No long debate in the lobby.

Costs and value, set realistically

Premiums shift by breed, age, and location. Younger pets are cheaper to start and keep covered. Larger breeds and flat-faced cats or dogs often cost more. Preexisting conditions are typically excluded. You pay a premium now so that a future, unpredictable bill doesn't derail savings. The value shows up in crises you can't schedule.

What makes a plan strong

- Reimbursement basis: Actual vet bill beats a fee schedule that caps line items.

- Annual limit: Higher is safer; unlimited is ideal if budget allows.

- Deductible: Annual deductibles are simpler than per-incident; pick an amount you can truly cover once.

- Co-insurance: The portion you pay after the deductible; 10 - 30% is common.

- Exam fees: Some plans include them; many don't.

- Waiting periods: Accidents may activate fast; knees/hips or illness often have longer waits.

- Bilateral clauses: If one knee is hurt before coverage, the other may be excluded; read this closely.

- Direct pay options: Not universal, but helpful if the vet and insurer support it.

- Customer support and claims speed: Days, not weeks, is the goal - your stress level notices.

Common exclusions and friction

- Preexisting conditions: Signs or diagnoses before start date or during waiting periods.

- Preventive care without a wellness add-on: Vaccines, routine dental cleanings.

- Breeding-related care: Often excluded.

- Behavioral therapy: Covered by some, excluded by others.

- Dental disease: Injuries usually covered; periodontal disease coverage varies.

- Experimental treatments: May be declined unless evidence-based.

Claims and reimbursements in practice

- Visit your vet. Approve recommended tests or treatment.

- Pay the invoice or request direct pay if supported (not guaranteed).

- Submit a claim via app or portal with itemized invoice and medical notes.

- Insurer applies deductible and co-insurance; you receive a breakdown.

- Reimbursement arrives in a few days to a couple of weeks, depending on the company and case complexity.

Expectations you can set now

No plan erases risk. A good one shifts it, predictably. You still budget some cash for deductibles, co-insurance, and excluded items. That said, coverage often turns a four-figure emergency into a smaller hit, which can be the difference between delaying care and acting quickly.

- Aim for decision-speed: Choose a plan before problems start; waiting periods are real.

- Align the deductible with your savings: Higher deductible lowers premium but increases the day-of bill.

- Check your vet's workflow: Many clinics upload records directly, which smooths claims.

- Keep records handy: Prior history clarifies what is or isn't preexisting.

- Review annually: Pets age; needs change; premiums adjust.

A small Tuesday-morning story

Luna slips on the stairs. A limp, then a yelp. At the clinic, the vet suspects a cruciate injury. The estimate is heavy. You open the app, the policy number autofills, and you upload the invoice with two taps. The tech gets the green light for X-rays. You leave with pain meds, a follow-up date, and an approval email pending. Not perfect, but the path is clear - and that's the value.

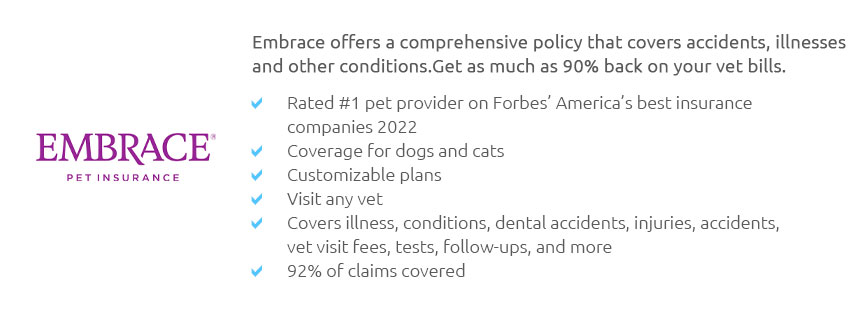

If you're comparing plans

- Coverage clarity: Accident and illness included? Exam fees? Rehab?

- Limits and caps: Annual limit, per-condition caps, sub-limits for imaging or cancer.

- Fine print on knees/hips: Waiting periods and bilateral rules matter a lot.

- Claim speed: Look for typical timelines; slower isn't always worse, but it can be stressful.

- Lifetime view: Starting earlier may keep conditions covered as they arise.

Measured honesty

Not every bill will be reimbursed, and not every insurer moves quickly. Still, most pet families report that the right plan reduces hard choices, especially in emergencies. That's the outcome to chase: freedom to say yes to care, even when the diagnosis is uncertain.

Closing thought

Choose a plan you understand, fund a small emergency cushion, and work with a vet who communicates clearly. Coverage may not make a crisis easy, but it often makes it solvable - and that shift, from worry to action, is worth a lot.